Crypto Tax Calculator: The Ultimate Guide to Simplifying Your Digital Asset Reporting in 2025

Crypto Tax Calculator solutions streamline the complex process of cryptocurrency tax

compliance. Learn how the best crypto tax software can help you accurately report

crypto taxes while maximizing deductions and minimizing audit risks.

The search for a reliable crypto tax calculator can be overwhelming for both new and

experienced cryptocurrency investors. As blockchain technology and digital assets

continue to reshape our financial landscape, the complexity of crypto taxes has

grown exponentially. Finding the right crypto tax software isn't just about

compliance—it's about optimizing your tax position and gaining peace of mind during

tax season.

The Growing Complexity of Cryptocurrency Taxation

Why Traditional Tax Methods Fall Short for Digital Assets

Traditional accounting methods simply weren't designed for the unique challenges that crypto taxes present. Unlike conventional investments, cryptocurrency transactions often involve:

- Multiple exchanges and wallets spread across various platforms

- Thousands of transactions occurring 24/7 across global markets

- Complex DeFi interactions including liquidity pools, yield farming, and staking

- NFT transactions with unique valuation challenges

- Cross-chain activities that can be difficult to track manually

- Airdrops, forks, and governance tokens with specialized tax implications

These complexities make manual tracking virtually impossible for active cryptocurrency investors. Even tax professionals without specialized cryptocurrency knowledge often struggle to properly account for these transactions. This is precisely why dedicated crypto tax software has become essential for investors who want to remain compliant while not overpaying their tax obligations.

Regulatory Developments Impacting Cryptocurrency Reporting

The regulatory landscape for cryptocurrency taxation continues to evolve rapidly across jurisdictions:

United States:

The IRS has intensified its focus on cryptocurrency compliance, adding specific cryptocurrency questions to tax forms and issuing increasingly detailed guidance. The infrastructure bill signed in 2021 expanded reporting requirements for "digital asset brokers," signaling heightened scrutiny.

European Union:

The Markets in Crypto-Assets (MiCA) framework is introducing more standardized approaches to cryptocurrency regulation, including tax reporting requirements, across member states.

United Kingdom:

HMRC has developed detailed guidance for cryptocurrency taxation, distinguishing between different types of tokens and activities.

Australia:

The Australian Taxation Office (ATO) has implemented data-matching programs with

cryptocurrency exchanges to identify unreported transactions.

These evolving regulations make it critical to use a crypto tax calculator that

stays current with jurisdiction-specific requirements and can adapt to regulatory

changes.

Core Components of Effective Crypto Tax Software

Automated Transaction Tracking and Categorization

The foundation of any reliable crypto tax calculator is its ability to automatically import and categorize your cryptocurrency transactions. This functionality should include:

- Comprehensive Exchange Support: Integration with major centralized exchanges like Coinbase, Binance, Kraken, and Gemini, as well as smaller platforms.

- Wallet Integration: The ability to import transactions from hardware wallets, software wallets, and blockchain explorers.

- Smart Transaction Categorization: Automatic identification of transaction types (buys, sells, trades, income events, transfers) to determine appropriate tax treatment.

- Historical Price Data: Accurate price information across multiple fiat currencies for calculating exact values at the time of each transaction.

- Error Detection: Built-in reconciliation to identify and flag missing transactions or inconsistencies that could lead to reporting errors.

The best crypto tax software solutions eliminate hours of manual data entry while minimizing the risk of overlooking taxable events.

Tax-Optimization Features and Analysis Tools

Beyond basic reporting, advanced crypto tax calculator solutions offer tools to optimize your tax position:

- Multi-Method Tax Modeling: The ability to compare tax outcomes using different accounting methods (FIFO, LIFO, HIFO, specific identification) to identify the most advantageous approach allowed in your jurisdiction.

- Tax-Loss Harvesting Identification: Tools that flag opportunities to realize losses and offset gains, potentially reducing your overall tax burden.

- What-If Scenario Planning Simulation features that allow you to model potential transactions and their tax impact before executing them.

- Year-Over-Year Analysis: Tracking your cryptocurrency portfolio and tax situations across multiple years to inform long-term investment strategies.

- Unrealized Gains/Losses Tracking: Monitoring the tax implications of your current holdings to make informed decisions about when to realize gains or losses.

These optimization features can potentially save investors significantly more than the cost of the crypto tax software itself.

Comparing Leading Crypto Tax Software Solutions

Feature Analysis of Top Crypto Tax Calculators

When evaluating crypto tax software, consider how these popular solutions compare on key features:

CoinTracker:

- Exchange Coverage: Excellent integration with major exchanges and wallets

- Tax Optimization: Offers multiple accounting methods

- DeFi Support: Good coverage of major protocols

- User Experience: Intuitive interface with portfolio tracking features

- Price Range: $59-$299+ based on transaction volume

TokenTax:

- Exchange Coverage: Comprehensive exchange and wallet support

- Tax Optimization: Advanced tax-loss harvesting tools

- DeFi Support: Strong DeFi and NFT transaction handling

- User Experience: Designed for more advanced users

- Price Range: $65-$3,499 based on features and transaction complexity

CoinLedger:

- Exchange Coverage: Good coverage of major platforms

- Tax Optimization: Basic optimization tools

- DeFi Support: Limited advanced DeFi support

- User Experience: Very user-friendly for beginners

- Price Range: $49-$299 based on transaction volume

Accointing:

- Exchange Coverage: Extensive exchange integration

- Tax Optimization: Includes portfolio optimization tools

- DeFi Support: Growing DeFi protocol support

- User Experience: Strong visual portfolio analytics

- Price Range: Free limited version, paid plans $79-$299

Koinly:

- Exchange Coverage: Broad exchange and wallet support

- Tax Optimization: Multiple accounting methods with tax previews

- DeFi Support: Good coverage of major DeFi protocols

- User Experience: Clean interface with strong portfolio features

- Price Range: Free for tracking, $49-$279 for tax reports

Selecting the Right Solution for Your Investment Profile

Transaction Volume: Higher-volume traders may need more robust solutions with unlimited transaction support.

Investment Complexity: DeFi users, NFT collectors, and multi-chain investors require more sophisticated tracking capabilities.

Technical Comfort Level: Some platforms offer more user-friendly experiences while others provide more powerful features with steeper learning curves.

Budget Considerations: While premium features come at a cost, the potential tax savings and time saved can provide significant return on investment.

Support Requirements: Consider whether you need access to tax professionals familiar with cryptocurrency or just technical support for the software itself.

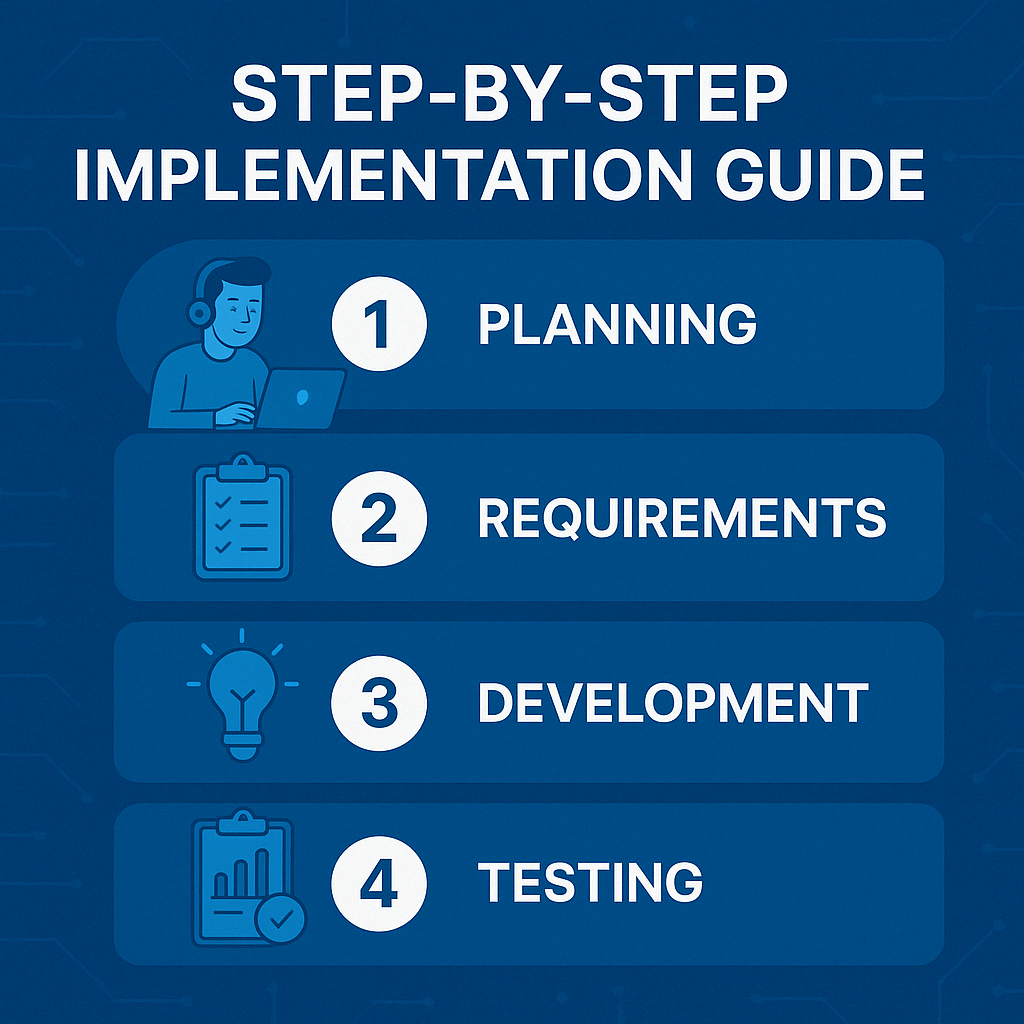

Step-by-Step Implementation Guide

Setting Up Your Crypto Tax Calculator for Success

Once you've selected a crypto tax software solution, follow these steps to ensure accurate tax reporting:

- Create a Comprehensive Exchange Inventory: List every exchange, wallet, and platform you've used for cryptocurrency transactions during the tax year.

- Gather API Keys and CSV Exports: For each platform, either generate read-only API keys or export transaction histories as CSV files.

- Connect Exchange Accounts: Use your crypto tax calculator's import tools to connect each exchange and wallet.

- Import Historical Data: Ensure you've imported data going back to your first cryptocurrency purchase, not just the current tax year.

- Review Imported Transactions: Verify that all transactions appear correctly imported and that beginning balances match your records.

- Check for Missing Transactions: Identify and manually add any transactions that weren't automatically imported.

- Classify Special Transactions: Properly categorize unique situations like gifts, donations, lost coins, or mining income.

- Select Your Cost Basis Method: Choose the accounting method that works best for your situation and is compliant with your jurisdiction's requirements.

- Generate and Review Tax Reports: Create preliminary tax reports and review them for accuracy before finalizing.

- Export to Tax Filing Software: Use your crypto tax calculator's export features to transfer the data to your preferred tax filing method.

Common Implementation Challenges and Solutions

Missing Historical Data: If you've lost access to old exchange accounts or wallets, you may need to reconstruct transaction histories using blockchain explorers or bank records showing transfers to exchanges.

Cross-Platform Transfers: Transfers between your own wallets aren't taxable events, but they can create confusion in your crypto tax calculator. Most software allows you to tag these as non-taxable transfers to avoid incorrect gain/loss calculations.

DeFi Protocol Complexities: Some DeFi interactions may require manual adjustments in your crypto tax software. Keep detailed records of complex interactions, especially for newer protocols that may not be fully supported.

NFT Valuation Issues: NFT transactions can present unique valuation challenges. Document floor prices or comparable sales at the time of transactions to support your valuation methods.

Handling Forks and Airdrops: Different jurisdictions treat these events differently. Ensure your crypto tax calculator is applying the correct tax treatment for your location.

Crypto Tax Planning Strategies

Year-Round Tax Management for Digital Asset Investors

Effective crypto tax management isn't just an annual event—it's an ongoing process that can significantly impact your overall returns:

- Regular Reconciliation: Instead of waiting until tax season, reconcile your cryptocurrency transactions monthly or quarterly using your crypto tax software. This prevents small issues from becoming major problems.

- Strategic Timing of Transactions: Consider the tax implications before executing large transactions. Your crypto tax calculator can help model the potential impact.

- Tax-Loss Harvesting Windows: Identify opportunities to realize losses before tax year-end to offset gains. Quality crypto tax software can flag these opportunities throughout the year.

- Donations and Gifting: Consider donating appreciated cryptocurrency to charity or using annual gift tax exclusions as part of your overall tax strategy.

- Retirement Account Utilization: Explore cryptocurrency exposure through retirement accounts where applicable to defer or reduce tax burdens.

- Jurisdiction Optimization: For international investors, understand how different jurisdictions treat cryptocurrency taxation and plan accordingly.

Working With Tax Professionals on Cryptocurrency Matters

While crypto tax software is essential, partnering with knowledgeable tax professionals can provide additional benefits:

Minimizing Audit Risk and Ensuring Compliance

Finding Crypto-Knowledgeable Advisors: Seek tax professionals with specific cryptocurrency experience who understand the nuances of digital asset taxation.

Collaborative Approaches: Use your crypto tax calculator to prepare detailed transaction data that your tax professional can review and provide strategic advice on.

Audit Support Planning: Develop a plan with your tax professional for responding to potential tax authority inquiries about your cryptocurrency activities.

Advanced Planning Opportunities: Explore entity structures, retirement strategies, and other advanced planning techniques that go beyond what crypto tax software alone can provide.

Regulatory Updates: Tax professionals can help interpret how new regulations affect your specific situation, complementing the technical capabilities of your crypto tax calculator.

Red Flags That Attract Tax Authority Attention

Inconsistent Reporting: Discrepancies between exchange reports and your tax filings can trigger automated flags.

Large Discrepancies Year-Over-Year: Sudden, unexplained changes in reported cryptocurrency activity may attract attention.

Missing Form 8949 Entries: Failing to report cryptocurrency disposals on Form 8949 when required can signal potential non-compliance.

Exchange Data Matching: As authorities receive more data directly from exchanges, mismatches with your reporting become more visible.

Excessive Like-Kind Exchange Claims: Improperly claiming like-kind exchange treatment for cryptocurrency trades made after 2018 (when this became explicitly disallowed for cryptocurrency in the US).

Unreported Income Streams: Failing to report mining, staking, or other cryptocurrency income that might be reported to tax authorities by platforms.

A comprehensive crypto tax calculator helps ensure consistent, complete reporting that reduces these red flags.

Documentation Best Practices for Cryptocurrency Investors

Transaction Confirmation Records: Archive confirmation emails, screenshots, or blockchain transaction IDs for significant transactions.

Exchange Account Statements: Save monthly or quarterly statements from all platforms where you hold cryptocurrency.

Acquisition Documentation: Maintain records showing how and when you acquired cryptocurrency, particularly for non-exchange acquisitions.

Valuation Evidence: For transactions involving assets without clear market prices, document how you determined fair market value.

Method Consistency Documentation: Use your crypto tax software to document that you've applied cost basis methods consistently.

Off-Exchange Transaction Records: Keep extra documentation for peer-to-peer transactions, including correspondence and payment confirmations.

Quality crypto tax calculator solutions offer secure storage for these documents, linking them directly to the relevant transactions for easy reference if needed.

Specialized Use Cases and Considerations

DeFi Participants and Yield Farmers

Protocol-Specific Integration: Look for crypto tax software with direct integration for the DeFi protocols you use most frequently.

Liquidity Pool Treatment: Ensure proper handling of liquidity provision and removal, including impermanent loss calculations.

Yield Tracking: Proper categorization of yield farming rewards, which may be treated as income rather than capital gains.

Gas Fee Attribution: Correct allocation of sometimes substantial Ethereum gas fees to cost basis calculations.

Impermanent Loss Documentation: Tracking and documenting impermanent loss for potential tax loss claims where allowed.

As DeFi continues to evolve, leading crypto tax calculator solutions are continuously expanding their protocol coverage and refining their handling of complex interactions.

NFT Collectors and Creators

Creation Expenses: Proper tracking of costs associated with creating and minting NFTs, which may offset income from sales.

Royalty Income: Ongoing royalty streams from NFT sales require different tax treatment than one-time sales.

Collection Valuation: Establishing defensible valuations for NFTs without active markets or with unique attributes.

Gaming and Metaverse Assets: Tracking in-game asset transactions that may have real-world tax implications.

Wash Sale Considerations: Understanding potential application of wash sale rules to NFT transactions in your jurisdiction.

Look for crypto tax software with robust NFT support if these assets represent a significant portion of your cryptocurrency activity.

Frequently Asked Questions About Crypto Tax Calculators

How accurate are crypto tax calculators for complex DeFi transactions?

Leading crypto tax software solutions have significantly improved their DeFi coverage, but complex or newer protocols may still require some manual adjustments. The most advanced tools now offer specialized integrations for popular DeFi platforms and provide clear guidance on how to handle unsupported protocols.

Do I need to report cryptocurrency I've held but not sold during the tax year?

In most jurisdictions, simply holding cryptocurrency does not trigger a tax reporting requirement. However, many countries require disclosure of cryptocurrency holdings above certain thresholds on information returns. Your crypto tax calculator should identify these reporting requirements based on your jurisdiction.

How do crypto tax calculators handle coins lost due to exchange hacks or wallet loss?

Most crypto tax software allows you to mark assets as lost or stolen, which may qualify for tax loss treatment depending on your jurisdiction's specific rules. Documentation of the loss is critical for substantiating such claims.

Can crypto tax calculators help with tax reporting in multiple countries?

Some crypto tax software supports tax rules for multiple jurisdictions, allowing you to generate reports compliant with various countries' requirements. This is particularly valuable for international investors or those who have changed residency during the tax year.

How do I handle cryptocurrency received as payment for goods or services?

Cryptocurrency received as payment generally counts as ordinary income based on its fair market value when received. Your crypto tax calculator should allow you to mark these transactions appropriately, establishing both your income amount and your cost basis for future sales.

What if I've been trading cryptocurrency for years but haven't reported it on previous tax returns?

Your crypto tax software can help you create amended returns for previous years. Many tax authorities offer voluntary disclosure programs that may reduce penalties for previously unreported cryptocurrency transactions. Consulting with a tax professional is highly recommended in these situations.

How do crypto tax calculators handle margin trading and futures?

Advanced crypto tax software should support margin trading and futures transactions, though these complex instruments often require more careful review to ensure proper tax treatment. Look for platforms with specific features for derivatives if these make up a significant portion of your trading activity.

Taking Control of Your Crypto Tax Reporting

As the cryptocurrency ecosystem continues to mature, so do the tools available for managing the associated tax obligations. A quality crypto tax calculator isn't merely an expense—it's an investment in compliance, potential tax savings, and peace of mind.

When implemented effectively, crypto tax software transforms what could be an overwhelming burden into a manageable process, allowing you to focus on your investment strategy rather than tax complexity. The right solution not only helps you meet your reporting obligations but can identify optimization opportunities you might otherwise miss.

Remember that while technology continues to improve, the combination of powerful crypto tax software and knowledgeable human expertise often provides the most comprehensive approach to cryptocurrency tax management. By selecting the right tools and developing sound tax practices, you can navigate the evolving cryptocurrency tax landscape with confidence.

Whether you're a casual investor or a daily trader, a DeFi enthusiast or an NFT collector, the right crypto tax calculator can make tax season significantly less stressful while potentially improving your after-tax returns. In the rapidly evolving world of digital assets, this peace of mind is invaluable.

Crypto Tax Calculator. All rights reserved

Contact Us

Interested in partnering with Crypto Tax Calculator or discussing business opportunities? Contact our team to learn more about collaborations, retail opportunities, and corporate solutions.

Business Contact Information:

- Business Inquiries: [email protected]

- Partnership Requests: Fill out our Partnership Form

Connect with Us:

Learn More: Visit compoundfinance.com/business for our full range of corporate services.